Your property taxes are not business as usual this year and interest rates are the biggest reason.

The Lubbock Central Appraisal District (LCAD) mailed out tax notices on April 4, and LubbockLights.com heard several local homes dropped in taxable value.

That’s not ordinary. So, we called LCAD’s chief appraiser Tim Radloff.

“I don’t think homes are selling for list [price] or above,” Radloff said.

Maybe some. But plenty of them are not, he said.

“That’s a little off from what we have seen in years past,” said Radloff.

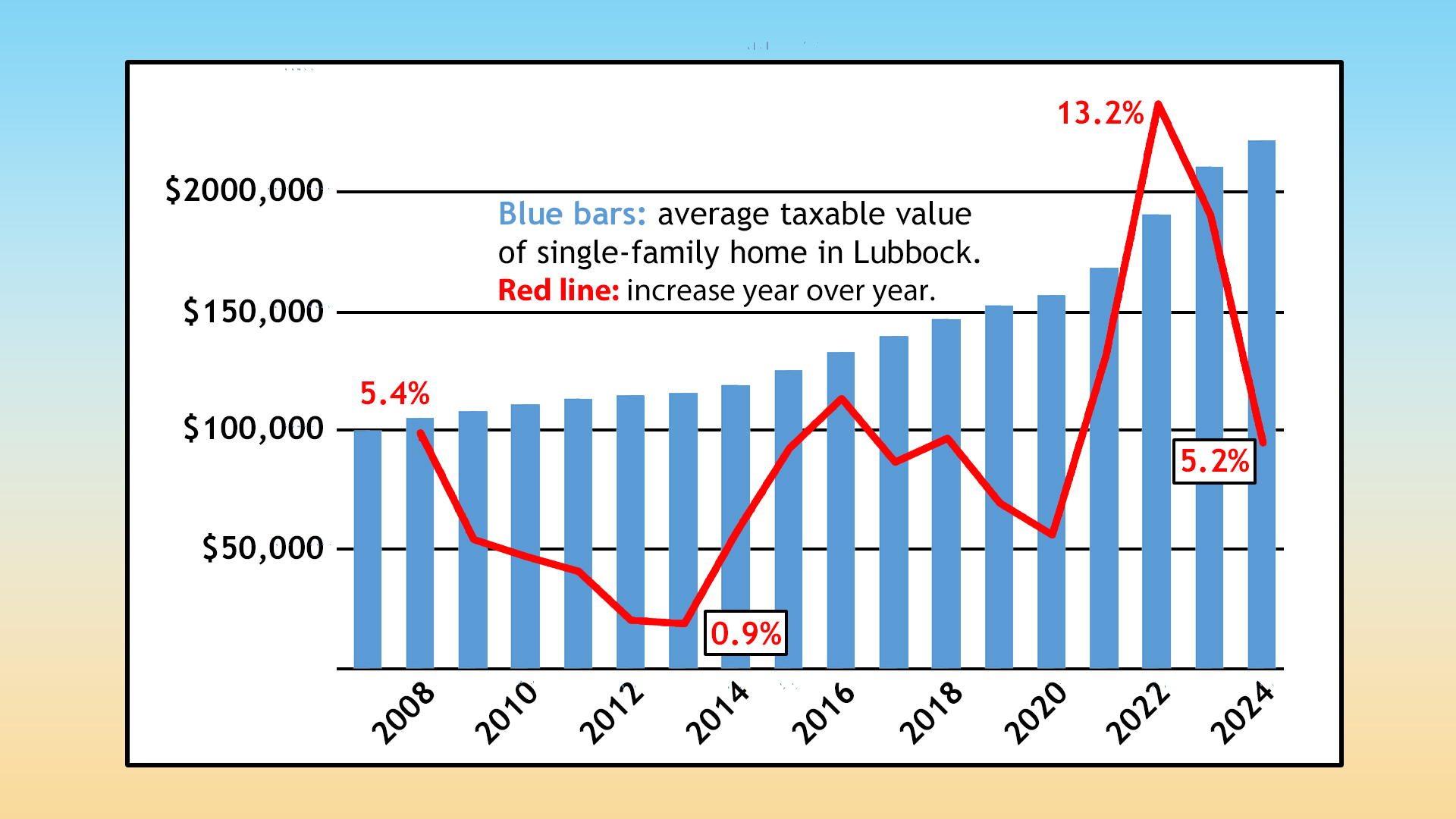

Using numbers from the LCAD website, Lubbocklights.com did some analysis. From 2008 to 2024, the average yearly increase in taxable value in Lubbock (city, not county) was 4.9 percent. The outliers were 2022 and 2023 when the taxable values went up 13.2 percent and 10.6 percent respectively.

Radloff won’t have the current average taxable values until the end of the month. But the sticker shock folks saw in 2022 and 2023 is not happening this year.

“It does appear that appraisals are not going to have as a significant increase as they have in years past. There’s parts of Lubbock County and parts of the City of Lubbock that either stayed the same, went up, or went down. It just depends on what the sales are indicating in that particular area,” Radloff said.

Why?

LubbockLights.com asked why things are different this year. Radloff mentioned interest rates, which roughly doubled in the last few years.

“I don’t think you’re going to be able to buy as much house, so that may be holding folks back,” Radloff said.

Andrea Sturdivant, president of the Lubbock Association of Realtors, reacted to Radloff’s observation on interest rates.

“That is true. We have seen an increase of interest rates, especially all through last year. It impacted sales especially the last five to six months of last year,” Sturdivant said.

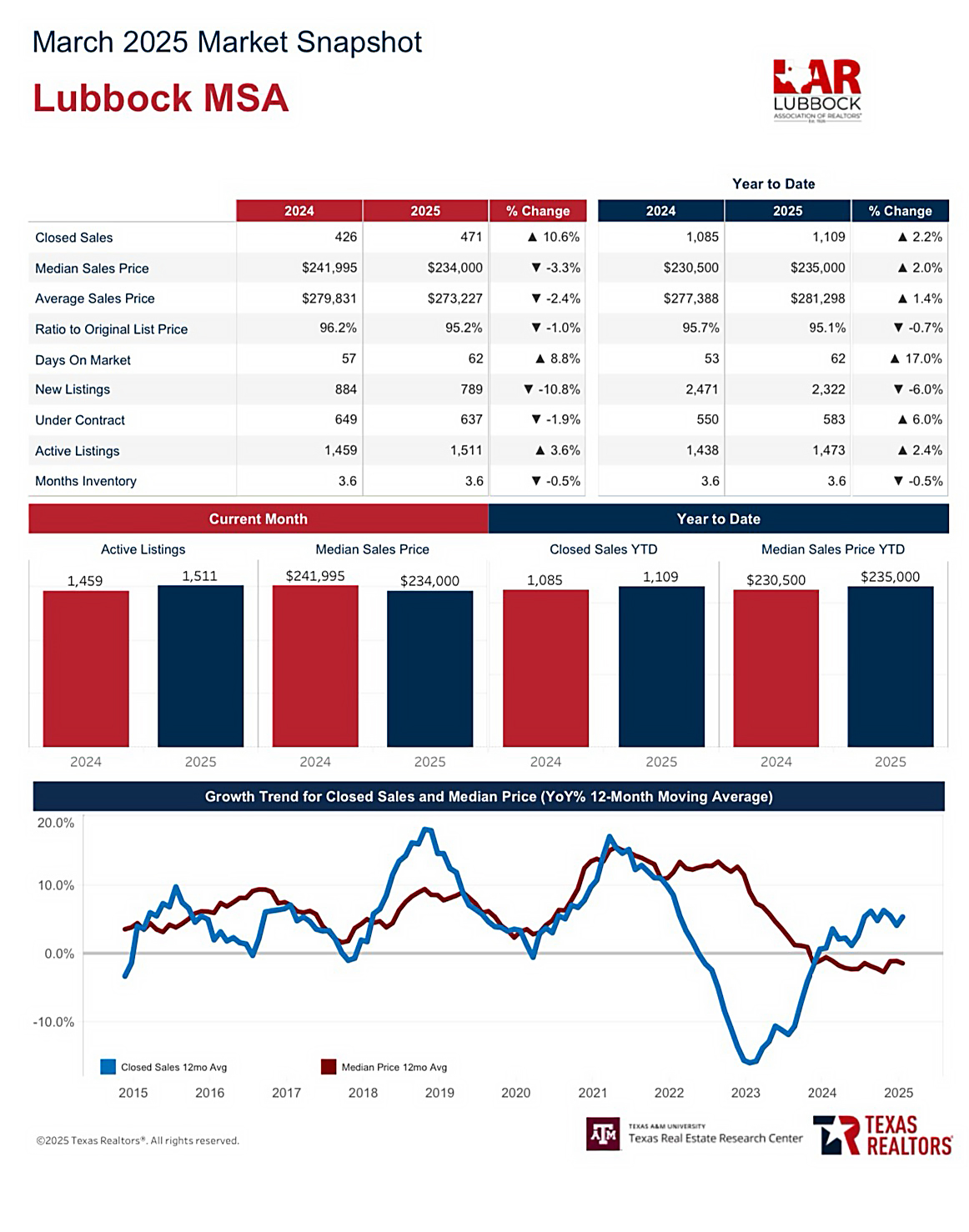

She also provided a chart which showed home prices are up year-to-date but just barely. Comparing March with the same time last year, average sales prices are down a little.

Sturdivant described the increases of 2022 and 2023 as almost crazy.

“We gave some of that back at the end of last year. But 2025 sales are steady,” Sturdivant said.

The importance of protests and exemptions

Sturdivant encourages people to protest the taxable value if the appraisal seems too high. A Realtor can do “comps” or comparison between your home and recent sales in your neighborhood.

“I would contact a Realtor and see what recent comparable properties in their neighborhood have sold for. If ‘comps’ are lower, they might have grounds for an appeal,” Sturdivant said.

“The homestead exemption is very important,” Sturdivant added.

For school taxes the exemption is worth $100,000. (For cities, it’s more complicated.) But the exemption is not automatic. You need to request it either online or in person at the LCAD office.

There’s also a ceiling or freeze on the taxable value of a homestead owned by someone who is disabled or over the age of 65. But again, these breaks are not automatic.

“You do have to ask for them,” Sturdivant said.

Fewer protests? Probably not

We asked Radloff if a slowdown in rising appraisals means owners are slower to protest.

“I would not put those two together in the same sentence, no. … I would not say there would be fewer protests,” Radloff said.

That’s because there’s no penalty for protesting. The only cost is your time. However, there are deadlines.

“Between now and the end of the month, you could walk in and have an informal [protest] with one of our appraisers right now,” Radloff said.

There’s also a formal protest. You can fill out a form from the tax office or get started online.

“The protest deadline is May 15th. We have to certify [preliminary values] to the taxing units by July 25th,” Radloff said.

Please click here to support Lubbock Lights.

Comment, react or share on our Facebook post.

Facebook

Facebook