Wolfforth Welcome sign, Donald Preston Drive (82nd Street) and Marsha Sharp Freeway. Staff photo.

Wolfforth needs to triple its water infrastructure if it wants to stay up with growth projections. And borrowing the money for that endeavor just got easier.

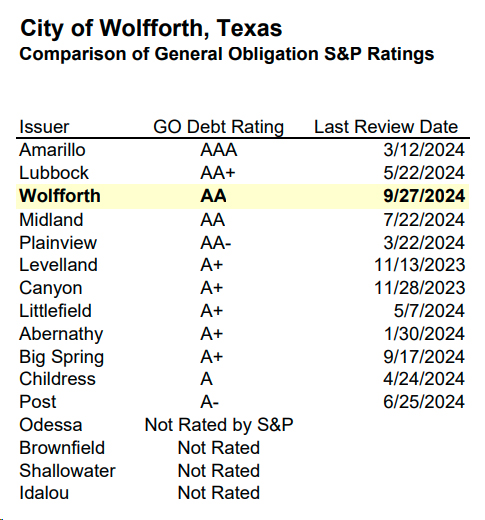

On September 27, S&P Global Ratings raised Wolfforth’s bond rating from AA- to AA. In simple terms, Wolfforth punched way above its weight class and can borrow money at a lower interest rate. (See the rating chart from S&P further below.)

Randy Criswell, city manager, said financial experts predicted Wolfforth could borrow $12.75 million at 4.7 percent. But with the higher bond rating, it dropped to 4 percent.

“Over the life of those bonds, the difference between 4.7 and 4 is nearly $1.9 million,” Criswell said.

“Whether or not I can say that we would have had a 4.7 percent interest rate on loan bonds at AA-, I don’t know that. But I do believe that being upgraded from AA- to AA made a difference of at least hundreds of thousands of dollars,” Criswell said.

“I’m proud of that. That AA rating is something special. … It’s really nice to see my colleagues from around the state look at me and say, ‘Man, that’s well done. Good job.’” – Randy Criswell.

“A bond rating for a city for could be very loosely compared to a credit rating for an individual,” Criswell said.

For a city, it’s that same analysis but “on steroids” and a thousand times deeper, he added.

How the money gets used

The $12.75 million bond goes to a water tower, underground water tanks, booster pump stations and distribution pipes.

“We’ve actually got our elevated storage tank project out for bid literally as we speak with our intent being to award that bid next month in November,” Criswell said.

Construction on the elevated storage (a water tower) will start in early 2025.

In the future, Wolfforth will need additional pipes, a new water treatment plant, and additional water supplies from Lubbock or from other sources. The city will need to borrow $16 million about a year from now and then up to $3 million in 2026, Criswell said.

This debt gets paid on the water bill – not property taxes.

Legally, the city could pay it with property taxes, Criswell said. And S&P based its credit rating more on the tax base rather than revenue from the water bills.

The S&P Global rating system

Investment Grade

AAA – Extremely strong capacity to meet financial commitments

AA – Very strong capacity to meet financial commitments

A – Strong capacity to meet financial commitments, but somewhat susceptible to economic conditions and changes in circumstances

BBB – Adequate capacity to meet financial commitments, but more subject to adverse economic conditions

Speculative Grade

BB – Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions

B – More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments

CCC – Currently vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments

CC – Highly vulnerable; default has not yet occurred, but is expected to be a virtual certainty

C – Currently highly vulnerable to non-payment, and ultimate recovery is expected to be lower than that of higher rated obligations

D – Payment default on a financial commitment or breach of an imputed promise; also used when a bankruptcy petition has been filed

Source: spglobal.com

Why S&P raised the rating

“The rating reflects our opinion of the city’s rapid tax base growth …” S&P said in a statement to prospective investors.

The market value of property in Wolfforth more than doubled in the last five years.

“Wolfforth has experienced rapid residential growth due to its location bordering Lubbock, which serves as the regional economic, education, and health-care center for a 26-county region in West Texas,” the investor statement said.

“Officials indicate there are multiple single-family housing developments in various stages of completion, averaging more than one rooftop completion daily,” S&P said.

There’s no reason to think growth will also stop in the next two years, S&P said. Wolfforth also had higher income compared with the surrounding area and a history of “strong revenue growth, somewhat offset by elevated debt.”

S&P mentioned debt as a one reason it would be difficult for Wolfforth to go any higher than an AA rating.

Current debt

The city owes nearly $22 million. Of that amount, a little less than $5.6 million is paid by property tax and a little more than 16 million is paid by utility customers.

The total debt is $5,677 per capita, S&P said.

“When I got here, the city of Wolfforth had a AA- bond rate which is actually a good rating for us to be that size,” Criswell said. The city was 3,000 people smaller at the time.

“That’s a beautiful thing to see that bond rating at AA for Wolfforth,” Criswell said.

Water for more people

A figure recently posted on texas.gov put the Wolfforth population at more than 8,000 people, which was even higher than Criswell anticipated.

Wolfforth Population

- 2020 Census: 5,521

- July 2023 estimate: 7,871

- Jan. 2024 estimate: 8,345

- The January estimate is a 51 percent increase over Census.

Source: texas.gov

“I figure about 2027, we’re probably 10,000 and our population estimates are showing us … we’d conceivably be 20,000 by 2050,” Criswell said.

But those are not hard numbers.

“Those are nothing more than estimates,” Criswell said.

Comment, react or share on our Facebook post.

Facebook

Facebook