The Lubbock City Council recently approved $66 million of debt for the Lake 7 water project – part of an estimated $251 million in debt for that and related projects.

Even before that money gets borrowed, the city’s debt is close to $1.8 billion.

Is that a problem?

LubbockLights.com explored the debt and this is what we found:

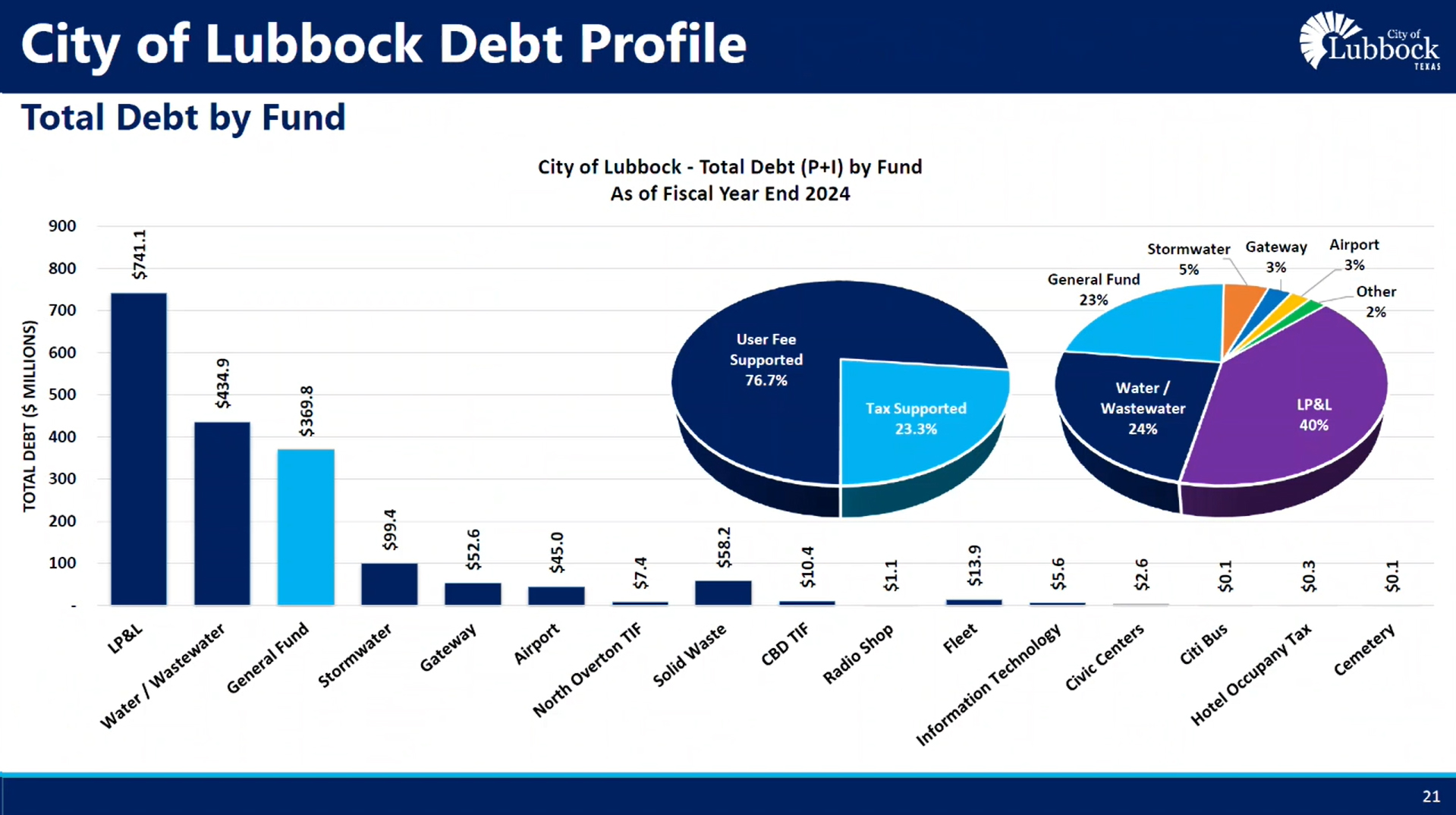

- Roughly 40 percent of the debt is Lubbock Power & Light – mostly tied to infrastructure connecting to the ERCOT power grid.

- The next biggest chunk is for water projects, such as Lake 7 and Lake Alan Henry – as Lubbock continues to invest in water projects as the city grows.

- The debt number would climb if voters a road bond of more than $100 million on November’s ballot. Also, not all the money authorized in the 2022 bond has been borrowed. The bulk of expenses for Lake 7 start in 2028.

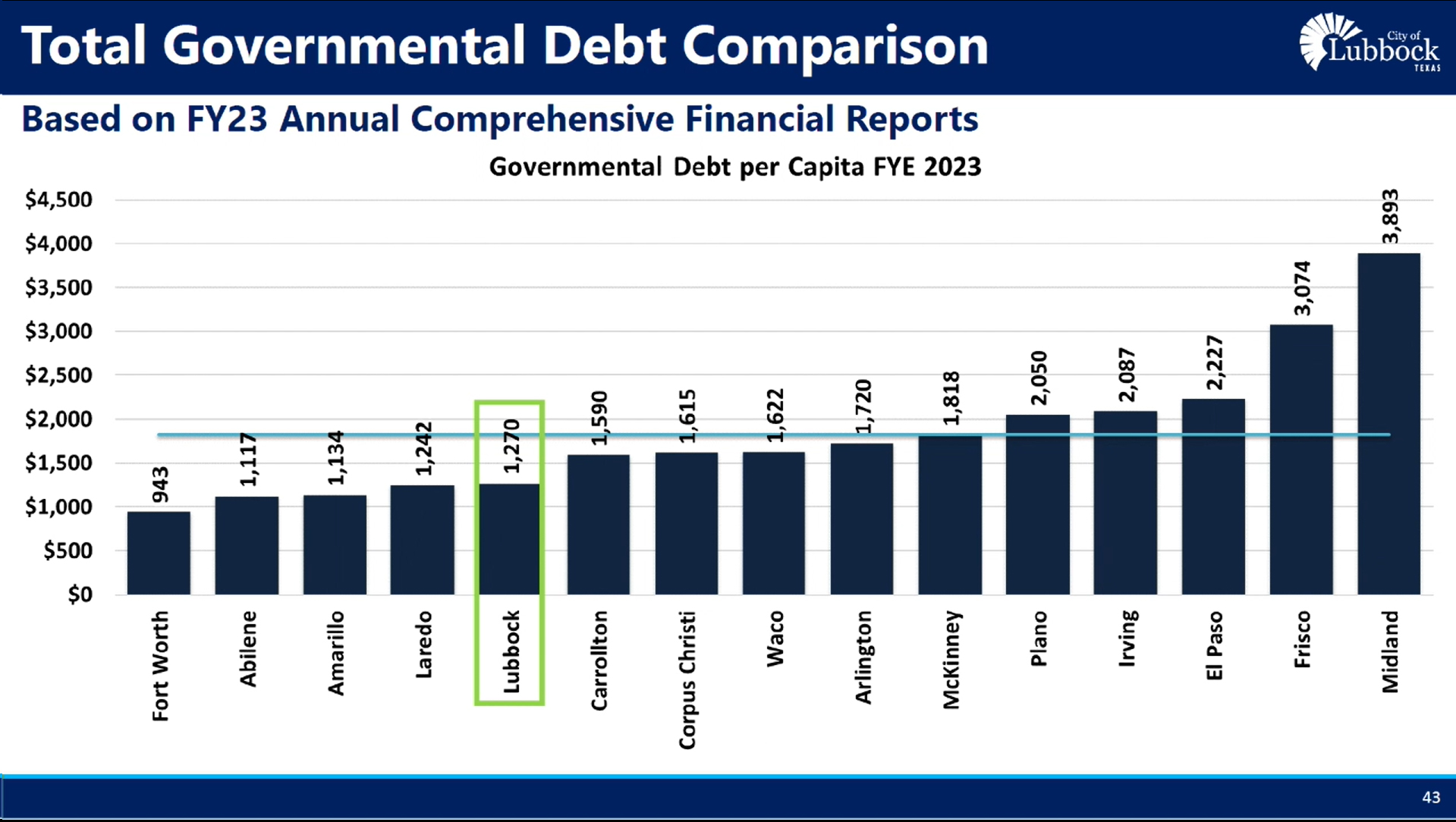

- Lubbock has governmental debt (read on for more about that) of $1,270 per person. Midland’s is $3,893.

- Lubbock’s credit rating is AA+ – the only higher is AAA.

Local property taxpayers are responsible for $311 million, Jarrett Atkinson, city manager, said. Ratepayers and customers – water, power and a few other things – are responsible for the rest.

The exact number is $1,787,865,930 as of September 30. That’s the updated yearly number Lubbock will soon submit to state officials.

“In small business we think about good debt and bad debt. We have assets to show for what we’ve borrowed money,” said Tim Collins, one of four new members on the City Council to take office in 2024.

“I don’t think I came into office saying, ‘Oh, my gosh! We’ve got to pay down debt,” Collins said.

LubbockLights.com reached out to the four new members of the Council to comment on the city’s debt: Collins, Brayden Rose, David Glasheen and Gordon Harris. Collins was the only one to accept our invitation to comment.

Lubbock’s credit rating

The city’s credit rating pays off, said Atkinson.

“We are borrowing at the absolute best rates that we can get. That reduces then the cost [of borrowing money],” Atkinson said.

Fitch Ratings assessed Lubbock’s credit rating in May and said Lubbock does a good job with spending control.

In May, the city had 34 percent of yearly spending in reserve – higher than Fitch demands for a good rating.

Fitch pointed out the city’s taxable value (rising market value plus new construction) was up 12 percent at the start of the year at $26.9 billion.

“Other rating factors include a strong population trend. The city is anchored by Texas Tech University’s large flagship campus with roughly 40,000 students. Large employers in the education, government and health services sectors lend stability to the city’s employment base,” Fitch said.

Two things might negatively impact Lubbock’s credit rating in the future, Fitch said: a 10 percent increase in long-term debt without an increase in revenues and a decline in reserves to less than 7.5 percent.

Taxpayer vs ratepayer debt

“Lubbock has $1,270 of governmental debt per capita,” Atkinson said.

He gets that number by taking the $311 million borrowed against property taxes and dividing it by the most recent population estimate. Atkinson said Lubbock compares well to other cities.

“The highest was Midland at $3,893. And the lowest is Fort Worth at $943,” Atkinson said.

But the total debt – the $1.8 billion number – is a different thing.

“It’s very difficult to compare our total outstanding debt to our peer cities because we have the power company. We have Lubbock Power and Light and very few cities have that,” he said.

Back in August during the city’s budget talks, Atkinson presented charts showing how the debt breaks down. The numbers have already changed slightly, but they still show approximately where the debt goes in 16 areas of the city budget.

LP&L debt more than doubled

“We are the largest piece of that debt,” said Harvey Hall, chief financial officer for Lubbock Power & Light.

LP&L’s debt more than doubled in recent years – now at $740 million including principal and interest – related to Lubbock’s switch to the ERCOT power grid. There’s an aggressive plan to bring down that number.

Leaving off the interest payments, Hall said, puts it at $539 million.

“Our utility carries typically around $200 million in debt. There’s a little over $320 million worth of transmission infrastructure investment to connect into ERCOT,” Hall said.

Click here to see our coverage of The Big Switch as LP&L moved into ERCOT and the competitive electric market.

Matt Rose, chief public affairs officer for LP&L, said, “We’re proud of the debt programs, so we’re happy to talk at length. … Our goal by 2030 … is to have paid down a substantial amount of the debt.”

“We’re focused on steadily bringing down the rates, aggressively paying down debts, but then also the third piece; pay into infrastructure,” Rose said.

Hall said LP&L will avoid borrowing more money in the next 5 to 8 years but at the same time spending money where it’s needed to take care of transmission lines, substations and so on.

LP&L’s role

The switch to ERCOT changed LP&L’s role. Now it’s a transmission and distribution company – not trying to make power or even deal with wholesale power purchases. That means it’s less likely to suffer financial turbulence.

“Right now, as of our last financial statement, we have $122 million in reserves,” Hall said.

That’ll come down to $70 million as more debt gets paid.

Fitch rated LP&L separately from the city and raised the rating recently from A to A+.

S&P Global and Moody’s also gave LP&L better ratings this year after the switch to ERCOT, Hall said.

Find a balance

Collins, the owner of a small business called Collins Tile & Stone, said, “We have to find a balance of how we’re going to use debt versus our tax rate.”

“If I had to start a business – even something as small as mine – if I had to start it without any debt, without any credit, without any borrowing capacity at all, it’s virtually impossible,” Collins said.

“We can pay cash for all this stuff. I’d love to. But it’s not gonna be 47 pennies on the [tax rate]. That’s gonna be a buck 50.” he said. “Previous councils, current and previous administrators have done a good job of managing the needs versus wants.”

Collins thinks there have already been improvements in recent years and pointed to Fitch as evidence he’s not the only one saying it.

“You’ve got the worldwide leaders in finance saying those very same things,” Collins said.

As one example, he said street maintenance.

“We’ll cash fund about $15 million worth of street repair [in the current budget]. That’s a big deal,” Collins said. The cash funding of street repair has been increasing every year since Atkinson became city manager in late 2016.

Getting away from a master lease program is another. That’s where a bank would lease vehicles or big equipment and then sub-lease them to the city. Collins said the city paid for things even beyond their useful life.

Comment, react or share on our Facebook post.

Facebook

Facebook